Understanding of trading risks with throne (TRX) and market dynamics

The world of cryptocurrency trading has increased exponentially in recent years, many investors taking advantage of the potential of large returns. Among the different cryptocurrencies, are noted as a leading alternative to traditional Fiat coins: TRON (TRX). As a decentralized platform that allows safe, fast and free transactions, the throne has obtained a significant traction among traders. However, before you sink into the world of TRX transactions, it is essential to understand the risks involved.

What is the throne?

TRON is an open-source platform, based on blockchain, which allows developers to build, implement and manage smart contracts on its network. Cryptocurrency native of the platform, TRX (previously known as a throne), is used for different purposes, including payment, staking and government transactions. TRX has a limited offer of 21 billion coins and is related to the US dollar.

Market dynamics: A high risk environment

The cryptocurrency market is inherently volatile, prices rapidly fluctuating in response to market feeling, regulatory changes and other factors. The dynamics of Tron’s market is no exception:

* Volatility

: TRX has registered significant price changes, often on a single trading day.

* Liquidity : Trx liquidity on exchanges is relatively low, which makes it difficult for traders to buy or sell the currency at favorable prices.

* Regulatory uncertainty : The regulatory environment that surrounds cryptocurrencies is still in evolution and is subject to change. This uncertainty can affect the confidence of investors and the feeling of the market.

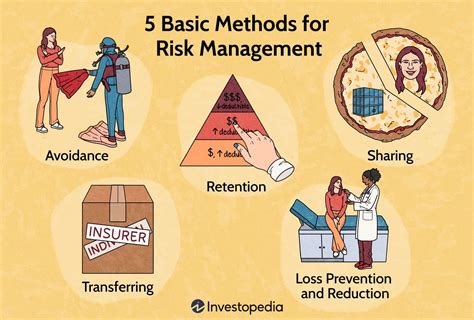

Risks associated with trading with throne (TRX)

While TRX offers a number of benefits, including fast transaction times and low taxes, the following risks should be considered:

* market risk : The cryptocurrency market is extremely susceptible to price changes, which can lead to significant losses, if not properly managed.

* Regulatory risks : Changes in regulatory policies or laws that regulate cryptocurrencies can affect investor confidence and market feeling.

* Security risks : The decentralized nature of blockchain technology makes it vulnerable to hacking and other security threats.

* Liquidity risks : Low exchange of exchanges can limit the ability to buy or sell TRX at favorable prices.

Investment strategies for the throne (TRX)

To alleviate these risks, investors should consider the following strategies:

* The average of the costs in dollars : Invest a fixed amount of money at regular intervals to reduce the impact of market volatility.

* Position size : Limit the trading size to avoid significant losses in case of a single trade against you.

* STOP-LIERDER ORDERS : Set Stop-Predency commands to limit potential losses if the price is moving against you.

* Diversification

: Spread investments on multiple cryptocurrencies and assets to reduce exposure to any market or security.

Conclusion

Trading with throne (TRX) presents significant risks, including market volatility, regulatory uncertainty, security threats and liquidity risks. While TRX provides a number of benefits, investors should be aware of these risks before deciding to trading on the platform. By understanding the market dynamics and implementing effective investment strategies, traders can minimize their losses and maximize potential earnings.

Disclaimer

This article is only for informative purposes and should not be considered as investment tips. TRON (TRX) is a relatively new cryptocurrency, with limited historical data, and its performance can fluctuate significantly in the future. Investors should consult with financial advisers before making investment decisions.