How to use candle graphics for market analysis in cryptocurrency

The world of cryptocurrency trade is a complex and rapid rhythm environment, and prices fluctuate rapidly due to market feeling, economic indicators and other factors. An effective way to analyze the market and make informed commercial decisions is through the use of candle graphics. In this article, we will explore how to use candle graphics for cryptocurrency market analysis.

What are candlestick lists?

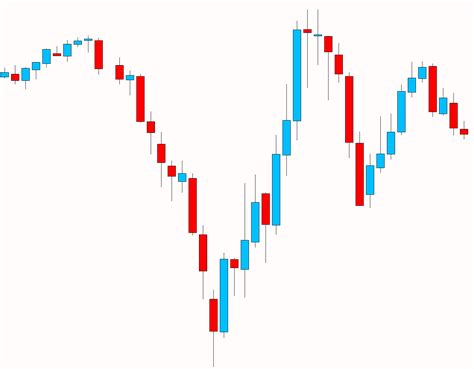

Candle graphics are a type of technical analysis tool used in several financial markets, including actions, future and cryptocurrencies. The graph shows the closing price of an asset over time with additional lines and symbols that represent different types of data. Each candle represents a single negotiation day or bar period.

Key components of a candle table

A standard candle chart consists of four main components:

- Body : The average section of the candle, which represents the highest price (green) and the lowest (red) price.

- Shadow : A smaller body under the main body, which represents the difference between the closing price and the opening price.

- Wick : The long and thin line extends from the top and bottom of the table, representing the opening and closing prices.

- Pips : The distance between two consecutive candles bodies.

How to use candle graphics for cryptocurrency trade

When analyzing cryptocurrency markets that use candle graphics, here are some key things to take into account:

- Identify trends : Look for consistent price movements, such as trends up or down, which may indicate a strong purchase or sale signal.

- Analyze volume : Candles with increasing volume generally represent more purchase activity, while decreasing the sales pressure volume signals.

- Observe support and resistance : Identify support levels (in the short term) and resistance (long -term), where the price can bounce or break.

- Look for patterns : familiarize yourself with patterns of common graphics, such as triangles, wedges and head and shoulders, which can help you identify possible commercial opportunities.

Types of candle graphics

There are several types of candle graphs that you can use to analyze cryptocurrency markets:

- Momentum candleticks : focus on the direction of price movement over time.

- Medium reversion candles : Identify prices reversions, which can be used as a basis for trade.

- Breakout candlesticks : Observe the candles that break the previous resistance levels or exceed the previous maximums.

Popular cryptocurrency trade tools

To improve the analysis of your candle table, consider using the following popular cryptocurrency trade tools:

- Commerce : A robust platform that offers advanced candle graphs and technical indicators.

- Coinigy : A comprehensive tool that provides detailed market data, graphic capabilities and automation functions.

- Cryptoslate : A professional grade platform to analyze cryptocurrency markets with real -time updates.

Conclusion

Candle graphics are a powerful tool for merchants in the cryptocurrency market, allowing you to identify trends, patterns and levels of support and resistance rapidly. By dominating the use of candle graphics and taking advantage of popular commercial tools, you can make informed decisions and increase their chances of success in the accelerated world of cryptocurrency trade.

Tips and tricks

- Always use a 1 minute or 5 minutes table to capture short -term price movements.

- Combine candle graphics with other technical analysis tools, such as RSI (relative force index) and Bollinger bands, for a more complete market analysis.

- Keep updated with the news and events of the market that can affect cryptocurrency prices.