How to use trading strategies for better results in cryptocurrency

The cryptocurrency trading world is a high -risk, high pay game. With the wide range of available platforms and tools, it can be a challenge to navigate the market and make conscious decisions on when to buy or sell. However, with effective trading strategies, you can increase your chances of success and achieve better results in this fast -changing landscape.

What are trading strategies?

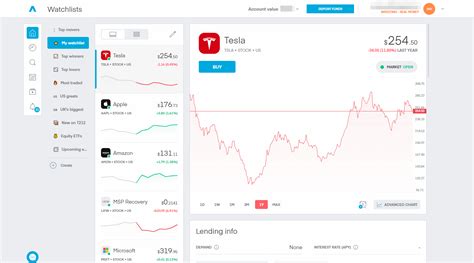

Trade strategies apply to a set of rules, techniques and guidelines you follow to manage your transactions. They may include technical analysis methods, such as changing average and trend lines; Basic analysis approaches, such as information based or on economic data -based decisions; And more complex, algorithmic systems for automated trade.

Types of Trade Strategies

There are several types of trading strategies you can use to improve your results in cryptocurrency markets:

1

Technical Analysis (TA) Strategies : It includes diagrams and model analysis to predict price movements. Popular methods are:

* Variable average crossovers: When the short -term MA crosses above or below the long -term MA, it can signal possible buying or selling options.

* Trend Lines: Horizontal lines connecting two points in the chart, pointing to the direction of the trend.

- Basic Analyzes (FA) Strategies : FA includes basic data analysis to predict price movements. Popular methods are:

* Trade with news: If market news releases or economic data is expected to affect prices, you can adjust your trading strategy accordingly.

3

Algorithmic Trade (AT) Strategies : Involving computer programs to automate transactions based on predetermined rules and parameters.

Benefits of using trading strategies

Using trading strategies can bring a number of benefits including:

- Improved Risk Management : By creating clear rules for entry and exit positions, you can reduce market volatility.

- Increased efficiency : Automated trading systems can help make more informed decisions in a small part of the time that would require manually analyzing the charts.

3

Advanced Market Knowledge : Trade strategies can teach you to read market and identify potential trends or models.

How to choose your trading strategy

The choice of trading strategy depends on your personal preferences, risk tolerance and market analysis skills. Here are some tips for choosing the right strategy:

- Start with fundamental analysis (FA) : If you’re new to cryptocurrency trade, consider starting with fundamental analysis strategies. They can provide a valuable insight into the main economy in the market.

- Experiment with technical analysis (TA) strategies : As a beginner, its strategies can be particularly effective in identifying diagram models and trends.

3

Consider algorithmic trade (AT) : Strategies are ideal for experienced merchants who want to automate their trading process.

Tips for Effective Trade

Follow these tips to increase your chances of success:

- Develop a clear trade plan : Prefer pre -trade in advance your rules and parameters.

- Be aware of market news : Regularly monitor market news and updates to adjust your strategy as needed.

3

monitor your performance : Track regularly trade results to identify improvements in areas.

Conclusion

Trade in cryptocurrency is a challenging but rewarding experience. With effective trading strategies, you can increase your chances of success and achieve better results in this fast -changing landscape. Remember to choose a strategy that matches your skill level and risk tolerance, and always continue to learn and adapt to the market.